Nobody Tweets About Month 7 in Procurement

The Unicorn Porn Industrial Complex Is Making You Feel Like Shit for Building Real Software

“We got it,” she texted.

After weeks of our champion modeling business cases, late-night texts dissecting objections, and that demo that went so well, their CFO almost smiled, we finally received budget approval from one of the largest banks in North America.

I grabbed the champagne we’d been saving, made my way to our VP of Sales’ desk, bottle in hand, grinning like an idiot.

She looked me up and down. “I hope you didn’t open that.”

“But... we got it?” I stammered.

“We got budget approval. Now we have to go through procurement.”

“How long does that…”

“Months. And don’t say shit to the board yet. It ain’t over ‘til the wire hits.”

Deflated, I deleted my draft message to investors and slunk back to my desk.

That “done deal” took eight more months to close, even though we timed it perfectly: a new EVP hire who wanted to drive change, the right budget cycle, and a champion with real power. After demos, due diligence, and internal board approval, we still had:

Eight months in procurement

Two rounds of legal reviews (both sides)

A security audit that restarted everything

Walking away from the deal twice

Two bank reorgs

A new EVP replacing our champion

A bajillion contract redlines

One lawyer’s call that lasted four hours

This, my friends, is real enterprise B2B software.

The Unicorn Porn Industrial Complex

Meanwhile, on Twitter/X:

“$2MM in three months used to be impressive. Now we expect it in ten days. Right now, momentum is the only moat.” - Bryan Kim

I can’t get lawyers to review an MSA in ten days.

Sigh, where do I start? This messaging isn’t just annoying, it’s dangerous. Because founders building real enterprise businesses are looking at this shit and thinking they’re failing. It’s like we briefly learned about growth at all costs during the heady ZIRP days, and now we've completely forgotten.

Let’s break down the numbers with the math everyone seems to forget exists.

$54,794.52 MRR × 36.5 = $2,000,000 ARR

Cool. Cool. Cool. Now show me:

The actual signed contracts

What happens when those subsidized LLM credits run out

Month 2 retention

Month 6 retention

CAC payback that isn’t fictional

Whether a single dollar is from a company with a procurement department

I could slap together an AI wrapper, charge $20/month, dump $50/month in free credits into each account, and watch people sign up. It would take me about ten days to hit those numbers, too.

You know what I couldn’t do in ten days? Get legal approval from a single Fortune 500 company.

What Actually Happens in Enterprise

Here’s the timeline nobody tweets about:

Month 1-2: The Honeymoon

Your champion loves you

Demos go great

“This is exactly what we need”

You start sizing your Series A and worrying about how you’ll manage your overflowing pipeline

Month 3-4: Reality Arrives

“We need to bring in IT”

“Security wants to do a review”

“Can you fill out this 47-page vendor questionnaire?”

We’ve onboarded you to NetSuite; now you get to re-enter that vendor questionnaire.

Your champion stops responding as fast

Month 5-6: Procurement Hell

“We’re mandated to get three quotes”

RFP goes out (to your competitors)

Bake-off begins

The deal you thought was done is now competitive

Month 7-8: Legal Thunderdome

Your lawyer meets their lawyer

Liability caps

Indemnification clauses

You need to double your insurance, which triples your premiums somehow

Data processing agreements

That one sentence that takes four calls to resolve

Month 9-10: The Near-Death Experience

“The deal is falling apart”

War room convened

Your champion’s boss has concerns

New stakeholder appears who hates everything except your competitor that they once implemented and are connected to on LinkedIn

Month 11-12: False Finishes

“We’re all set, just needs final signatures”

Org reorg happens

“It’s been more than 6 months; we need to redo the pen tests.”

New stakeholder wants to review everything

Your champion gets promoted/leaves/reassigned

Month 13-18: Actual Close

Wire hits

Now you can open the champagne

Now you can tell the board, but they’re already focused on the next deals.

This isn’t broken. This is the business model.

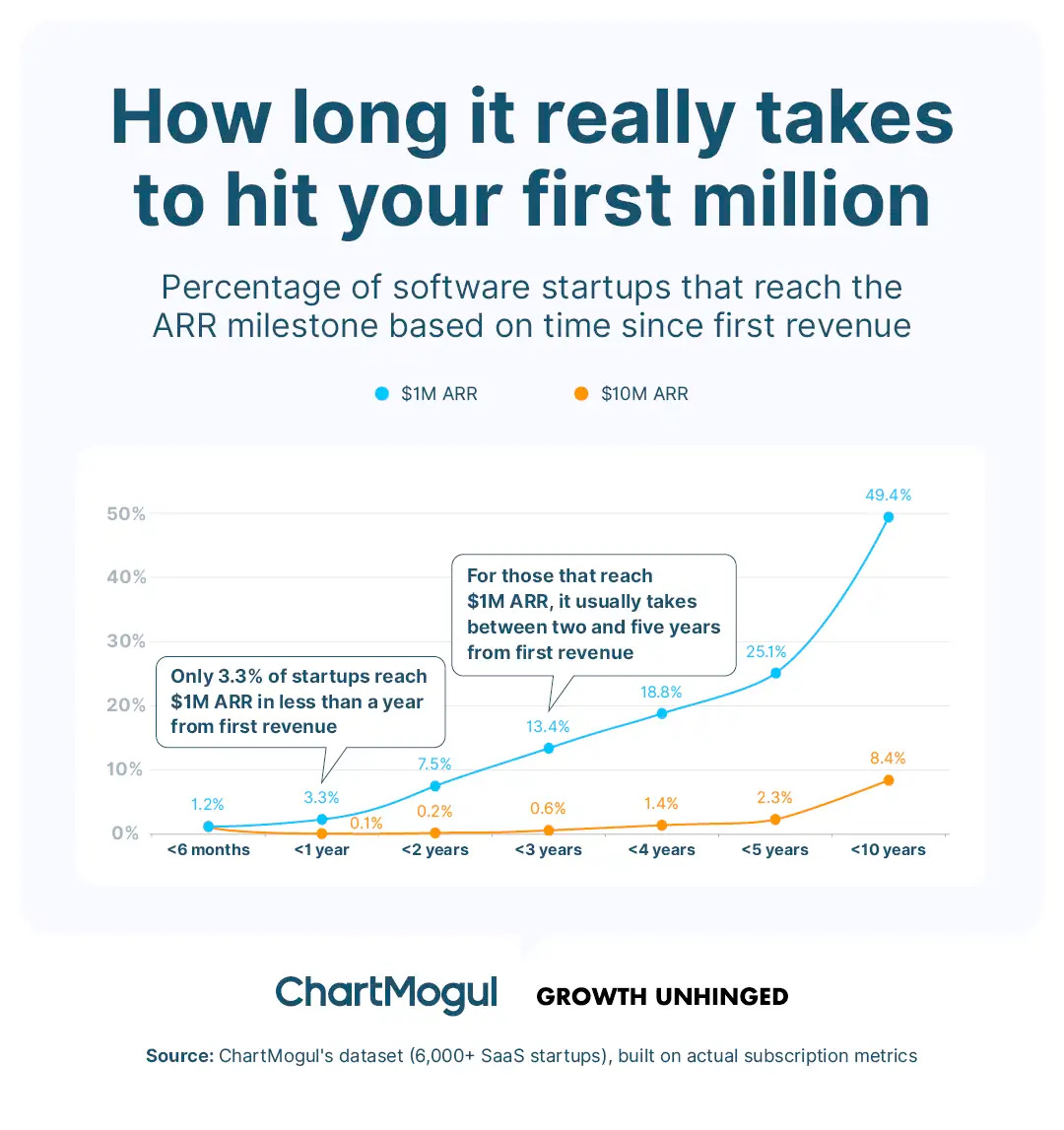

The Data Nobody Wants to Hear

Kyle Poyar’s research on growth benchmarks:

7.5% of startups hit $1MM ARR in under 2 years

3.3% hit it before year one

The median time to $1MM ARR? 2-3 years. You read that right, two to three years.

But wait, what about all those “overnight successes”? Kyle has the receipts.

Lovable: Eighteen months of development before their breakthrough, following previous unsuccessful attempts (GPT Engineer) that fizzled after launch. The “sudden” success had a year and a half of groundwork.

Clay: Six years of grinding before revenue traction. Six. Years. Most teams and investors would’ve called it quits, but then growth exploded. But nobody tweets about years 1-5. Side note: There are so many Clays, I think I may have used an earlier version, but I’m not sure.

StackBlitz: Seven years clawing to $700K ARR. Then Bolt.new hit $4MM in four weeks. Everyone talks about the four weeks. Nobody mentions the seven years.

And then my favorite, Cursor: the one everyone forgets. Eleven months of private development before their March 2023 launch. Then nine more months to hit $1M ARR. Now everyone screams about their explosive growth from $4M to $50M ARR in 2024. But that’s 20+ months after they started building. With zero marketing spend. And with a product developers literally couldn’t live without once they tried it.

So despite what you’re hearing, the pattern isn’t “build fast, win big.” It’s “build for years in obscurity, then maybe something hits.”

Why “Momentum as Moat” Is Specifically Wrong for Enterprise

Consumer/PLG businesses can move fast because:

Individual buyers making individual decisions

Credit card transactions

No procurement departments

No legal review

Can pivot weekly based on usage data

Enterprise businesses cannot move fast because:

Committee decisions with 8-12 stakeholders

Six-figure+ contracts requiring CFO approval

Mandatory procurement processes (seriously, it’s in their policies)

Legal reviews on both sides

Security audits

Integration with systems they literally cannot break

Reference calls from customers you don’t have yet

You know what the actual moat is in enterprise?

The fact that it takes 8-18 months to close a deal.

Your competitors have to climb the same mountain. Every logo you land is a castle they have to siege. Each implementation becomes integration debt for their competitive displacement.

Fast-follow doesn’t work when the “follow” takes a year and a half.

What This Means If You’re Building Enterprise

If you’re six months in and don’t have $1MM ARR, you’re not behind. You’re on time.

If your deals take 6-18 months to close, that’s not a bug. That’s enterprise.

If you have three pilots and zero revenue, you’re further along than the “10 days to millions” crowd with their phantom churn.

If procurement is killing you: Everyone. Every single company. This is the game, try to see it as a challenge, and remember it’s business, not personal. Well, most of the time.

Could you pivot to SMB? Price at $99/month? Let people swipe cards? Sure. Some companies should. But if you’re building for enterprise buyers, you’re playing a different sport entirely.

The Real Metrics That Matter

Stop comparing yourself to consumer SaaS:

Bad metric: Time to $1MM ARR

Good metric: Contract value + renewal rate

Bad metric: signup velocity

Good metric: Pipeline coverage at 3x quota

Bad metric: Daily active users

Good metric: Successful implementations/champion retention

Bad metric: Viral coefficient

Good metric: Reference customers willing to take calls. Customers who take you with them when they switch jobs.

Your $500K annual contract, which took 14 months to close, is worth more than $2MM in MRR that churns at 15% per month. Because in 12 months, you’ll still have $450K. They’ll have $350K.

Durability beats velocity in enterprise.

What Actually Kills Enterprise Startups

It’s not slow sales cycles.

It’s running out of money before the pipeline converts.

The math is brutal:

9-month sales cycle

Need 3 months to onboard/implement

First renewal at month 21

Need 18 months of runway when you start selling

Most enterprise startups die in “the valley of death”, that 12-18 month period where:

Demos are going great

Pipeline looks incredible

The board is asking about revenue

Your bank account is bleeding out

Nothing has closed yet

This is why enterprise founders need to:

Raise more than feels comfortable (you need longer runway)

Start selling earlier than feels ready (add 6 months to your timeline)

Have fewer, bigger targets (ten $500K deals > fifty $100K deals)

Get comfortable with awkward board meetings (where you explain why nothing closed yet)

Find the right investors who get B2B Enterprise, founder-investor fit is a real thing.

The Truth About Enterprise That Nobody Tweets

Real enterprise deals require:

Vendor insurance certificates

SOC 2 compliance (Type II, they don’t care about Type I)

Redlined vendor agreements (every single one)

Multiple reference calls

Security questionnaires that take 40 hours to complete

Proof of financial stability

Proof of D&O insurance

Integration with systems deployed in 2008 that nobody understands anymore

Your buyer isn’t being difficult. They’re betting their job on you.

They’re rolling you out to 5,000 users. If your shit breaks, they’re in a conference room explaining why they bought from a startup instead of the incumbent. Their boss is asking why they didn’t go with the “safe choice.” Their career is on the line.

They should move slowly. It’s the rational decision.

So What Do You Do?

If you’re building consumer/PLG, great. Move fast. Tweet your revenue. Optimize for momentum. None of this applies to you.

If you’re building enterprise:

“Don’t believe the hype” - Public Enemy, 1988

Stop reading Twitter unicorn porn threads. They’re not for you.

Stop feeling behind because someone’s MRR × 36.5 math went viral.

Stop apologizing for deals taking “too long.”

Your job isn’t to speedrun it. Your job is to survive it.

Start measuring:

Contract value

Pipeline quality

Champion conviction

Renewal rates (even from pilots)

Reference customer strength

Keep the champagne in the office. You’ll need it when the wire hits.

Just don’t open it when you get budget approval, like me, when I was a naïve idiot.