The Acquisition-Ready Product Playbook: A Strategic Guide for Series-A SaaS Leaders Balancing Growth and Exit Value

Frameworks, Timelines, and Strategies for Product Leaders Preparing for Exit

If you're a product leader at a Series A B2B SaaS company, you might already be juggling pre-acquisition tasks. The 2023 Challenges in Product Management Survey found that 32.4% of product leaders are diving into these activities, especially at companies in hot vertical markets. That’s a lot of you! So, how do you craft a product strategy that nails your current goals and makes your company a shiny target for acquisition? Spoiler: You don’t have to choose. The same strategy that fuels sustainable growth also makes you attractive to buyers.

The 2025 SaaS M&A report from SEG shows that companies commanding premium valuation multiples excel in metrics like Net Revenue Retention (NRR), Annual Recurring Revenue (ARR) growth, and solid unit economics. Now the bad news: exceptional performance across key metrics isn’t something you can achieve with some last-minute polish, but it’s definitely something an effective product strategy can drive. This guide is your playbook for building an acquisition-ready strategy that adds value now, whether you exit tomorrow or years from now.

A great product strategy holds immense value, but considering tech and talent hurdles, post-acquisition integration can hinder progress. High M&A failure rates indicate a gap between identifying product synergies and effectively realizing them.

Why SaaS Acquisitions Succeed (or Crash)

Acquisitions can go south fast. Here’s why they fail:

Integration headaches: Merging cultures and tech stacks, especially with cloud architectures and remote teams, is complex at best.

Customer churn: Churn can spike if customers perceive the acquisition as negative or experience service disruptions.

Product overlap: Duplicate features lead to internal battles and wasted effort.

Overhyped ‘synergies’: Buyers often overestimate cross-sell potential or underestimate integration costs or feasibility.

Key Success Factors for SaaS Acquisitions

But when acquisitions work, it’s because of:

A clear reason, like entering new markets, acquiring tech/talent, or boosting market share.

Strong product-market fit and customer loyalty.

Effective integration planning and execution.

Retention of key talent and leadership from the acquired company.

Knowing these factors helps you prep like a pro, reducing risks and highlighting what makes your company a winner.

Understanding the Acquirer's Perspective

What Acquirers Look For in Product Strategy Due Diligence

M&A due diligence isn't just about spreadsheets anymore. Buyers dig deep into your product strategy. Here's what they're really checking out:

Is Your Revenue Actually Good? And Growing?

ARR growth (30%+ gets them excited).

NRR above 100% (120 %+ is a valuation booster).

Low churn and sticky products.

Customer concentration (too much reliance on a few big clients raises red flags).

Are You Actually Making Money?

Gross margins (80 %+ is the SaaS sweet spot).

Rule of 40 (growth + profit margin > 40%).

LTV ratio (3:1 or higher indicates profitable customer acquisition).

CAC payback (less than 12 months is a win, but less is more).

SaaS Magic Number (how efficiently you spend to grow).

What Makes Your Product Special?

Unique tech or IP that stands out.

Leadership in your niche.

A big, growing total addressable market (TAM).

Competitive positioning and barriers to entry.

Is Your Tech Any Good?

Scalability of cloud infrastructure.

Security posture and compliance.

Tech debt assessment.

Robust API and integration capabilities.

A messy tech stack or heavy technical debt can tank synergies, jack up integration costs, and scare buyers off. A modern, scalable, well-documented tech stack significantly facilitates integration and contributes positively to valuation

Common Red Flags That Devalue Companies

You should be aware of issues that consistently raise concerns during acquisition due diligence:

Technical Debt Accumulation

Unmaintained legacy code

Poor documentation

Security vulnerabilities

Scaling limitations

Product-Market Fit Concerns

High customer churn indicating product or market issues

Low NRR, below 100%, suggests limited expansion potential

Uneven customer satisfaction scores across segments

Integration Challenges

Monolithic architecture resistant to modular integration

Custom technology stacks with limited compatibility

Data models that resist migration or normalization

Limited API capabilities

Team Dependencies

Knowledge concentration in a few key employees

Undocumented product decision processes

Lack of systematic product development methodology

Deal-Enhancing Elements in Product Strategy

Research identifies several product strategy elements that consistently drive premium valuations:

Vertical Market Leadership

Specialized solutions for specific industries command higher multiples due to deeper customer relationships and typically lower churn

Domain expertise embedded in the product creates defensible advantages

Platform and Ecosystem Strategies

Products with platform characteristics benefit from network effects

Strong API strategies and third-party integrations increase stickiness

Established developer ecosystems create additional value barriers

Scalable, Cloud-Native Architecture

Modern cloud infrastructure signals easier scaling and integration

Microservices architectures offer more flexible integration options

Containerization and infrastructure-as-code approaches streamline operations

Data and AI Capabilities

Unique data assets with demonstrable value

AI/ML capabilities embedded in core product functions

Analytics capabilities that drive customer value

Optimizing Your Product Strategy for Maximum Value

Strategic Technical Debt Management

Technical debt is inevitable in fast-moving startups, but successful acquisition targets manage it strategically:

Debt Inventory and Classification

Document and categorize technical debt by impact and resolution effort

Distinguish between "drag" debt (slowing development) and "risk" debt (creating vulnerabilities)

Quantify carrying costs in engineering time and opportunity cost

Prioritization Framework for Technical Debt

High Priority: Security vulnerabilities, scaling limitations, integration blockers

Medium Priority: Performance issues, reliability concerns, developer experience frictions

Lower Priority: Code cleanliness, minor architectural inefficiencies

Transparent Debt Management Process

Allocate consistent sprint capacity to debt reduction (15-20% is standard)

Document debt reduction in engineering and product artifacts

Create visible metrics tracking debt reduction over time

Acquirer-Ready Technical Documentation

Maintain architecture diagrams that illustrate system components and interactions

Document the API surface area thoroughly with usage examples

Create integration guides that demonstrate extensibility

Showcasing Product Differentiation

Product differentiation directly impacts valuation multiples. Research shows that differentiators should be:

Quantifiable in Business Impact

Document specific customer outcomes with metrics

Demonstrate ROI through case studies and success stories

Connect features to concrete business value

Defensible Against Competition

Identify capabilities not easily replicated by competitors

Document intellectual property and proprietary approaches

Show sustainable advantages in customer acquisition or retention

Aligned with Acquirer's Strategic Interests

Map differentiation to potential acquirer needs

Identify capabilities that align with the acquirer’s existing product portfolio

Demonstrate synergy potential through complementary strengths

Validated Through SaaS Metrics

Connect differentiation to observable metrics like NRR, conversion rates

Highlight pricing power through the sustainability of gross margins

Illustrate scaling efficiency through improving unit economics

Demonstrating Scalable Architecture

Acquirers pay premiums for products built to scale efficiently:

Performance Scalability

Document performance testing methodologies and results

Showcase linear cost scaling with customer/user growth

Highlight architectural decisions that enable scaling

Operational Scalability

Demonstrate automated deployment and testing procedures

Document incident response and reliability engineering practices

Show efficient use of cloud resources and optimization strategies

Team Scalability

Highlight your modular codebase that supports parallel teamwork

Showcase engineering onboarding processes and documentation

Demonstrate knowledge distribution across the team

Geographic and Compliance Scalability

Highlight multi-region capabilities

Document compliance frameworks and certifications

Show internationalization and localization readiness

Communication Frameworks for Pre-Acquisition Phases

Stakeholder Communication Within NDA Constraints

At some point, you’ll be under a strict NDA that will prevent you from speaking as candidly as you normally will outside of the board and a small internal group. If your default is transparency, this puts you in a difficult position. It can feel a little dirty, but navigating pre-acquisition discussions requires balancing transparency with confidentiality:

Investor Communications

Focus on strategic rationale rather than specific acquirers

Emphasize value creation potential rather than exit timing

Frame discussions around market consolidation trends

Example: "Our Q3 roadmap prioritizes integration capabilities and vertical market expansion, positioning us advantageously in our space as the industry consolidation trend continues."

Customer Communications

Maintain continuity messaging around the product roadmap

Emphasize long-term vision and commitment

Address concerns proactively if rumors emerge

Example: "We remain committed to our product vision and roadmap. The investments we're making in our platform architecture ensure we can continue to serve your needs regardless of how our company evolves."

Team Communications

Maintain consistent focus on the company's mission and goals

Connect organizational changes to business strategy rather than exit preparation

Emphasize professional growth opportunities in all scenarios

"Our increased focus on documentation and knowledge sharing strengthens our engineering practices and creates growth opportunities for everyone, while ensuring we build a resilient organization."

Roadmap Communication Template

At some point, you’ll need to introduce roadmap changes related to the acquisition process. This template maintains confidentiality when communicating those changes.:

ROADMAP UPDATE: [Initiative Name]

BUSINESS DRIVER: [Customer problem/opportunity being addressed]

VALUE DELIVERED:

- For customers: [Specific customer outcomes]

- For our business: [How this advances strategic goals]

KEY TIMELINE CHANGES:

- [Feature/initiative] moved forward to [date]

- [Feature/initiative] rescheduled to [date]

RATIONALE:

[Business-focused explanation connecting to stated company objectives]

IMPACT ON COMMITMENTS:

[How this affects (or doesn't affect) existing customer commitments]Planning for Joint Roadmap Scenarios

Preparing for Acquisition Discussions

In advanced acquisition stages, joint roadmap planning becomes critical. This is your opportunity to get ahead and actively influence the post-acquisition roadmap, as well as your chance to demonstrate value to the acquirer:

Current Roadmap Documentation

Organize roadmap into strategic themes rather than outcomes (and never feature lists)

Document clear business rationale for major initiatives

Classify initiatives by strategic impact vs. implementation complexity

Synergy Preparation Materials

Identify obvious integration points with likely acquirers

Document API capabilities and integration frameworks

Prepare "what-if" scenarios for different combination possibilities

Value Capture Modeling

Create templates for modeling cross-sell/up-sell opportunities

Identify cost synergies in infrastructure and operations

Quantify potential market expansion through combined capabilities

Sequencing Recommendations

Develop recommendations for integration sequencing

Identify quick wins vs. longer-term integration projects

Document dependencies and critical path considerations

Your Last Independent Roadmap: Making it Count

As acquisition discussions intensify, product leaders confront the harsh reality of crafting their last independent roadmap. Post-acquisition, focus shifts to integration, CapEx reduction, and aligning with the acquirer's KPIs. This makes your pre-acquisition roadmap critically important, and it's your last chance to set direction on your terms.

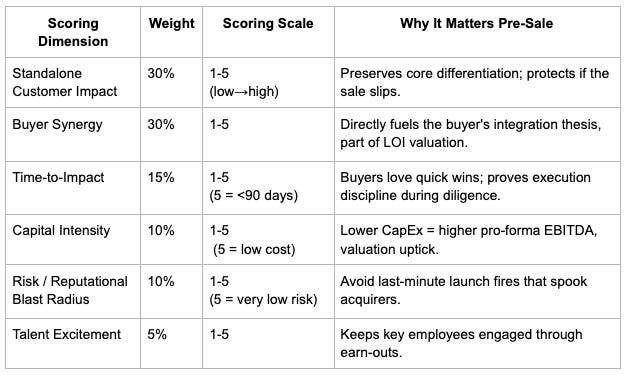

Deep-Dive: Roadmap Triage Mechanics & Rationale

Earlier, we talked about strategic roadmap considerations. Now, let’s dive into a more detailed scoring model that you can use on your board. This model can be implemented in a Jira/Linear field or spreadsheet to prioritize your final independent roadmap easily.

How to use this framework:

Calculate Total Score = Σ(Weight × Dimension Score) for each initiative

Rank epics by score and draw a cut-line at available capacity

Publish the sortable list internally with dollar values abstracted if the sale process is stealthy

Re-score monthly as diligence questions and buyer feedback change weights fast

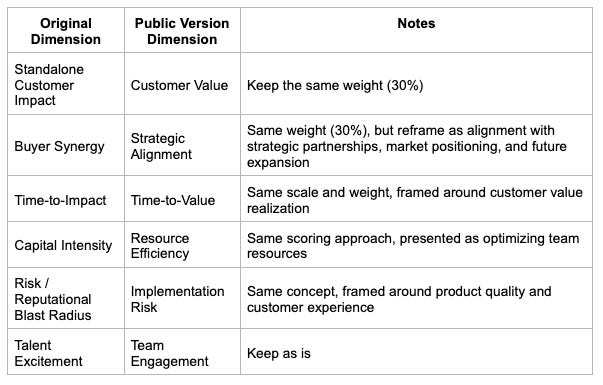

Adapting This Framework for Confidential Acquisition Scenarios

When acquisition discussions are confidential but you need to use this framework with your broader team, create a "public version" with these adaptations:

When presenting the prioritized roadmap internally, you can:

Use only the "public version" terminology in all communications

Omit any acquisition-specific rationales from documentation

Frame all prioritization discussions around building a stronger, more valuable independent company

Keep the detailed scoring spreadsheet confidential to the executive team

This approach allows you to apply the same prioritization framework while maintaining confidentiality around potential acquisition discussions.

"Kill List" Decision Framework

Not all initiatives deserve to survive in an acquisition context. Use these criteria to identify initiatives that should be stopped:

Total Score < 60% of cut-line this initiative is of low value in your new reality

Synergy Score ≤ 2, there’s minimal acquirer benefit

Launch date beyond likely close date, this initiative won't impact the deal

When publishing the Kill List internally, frame each decision through customer-value reasons rather than financial jargon to maintain team morale and focus.

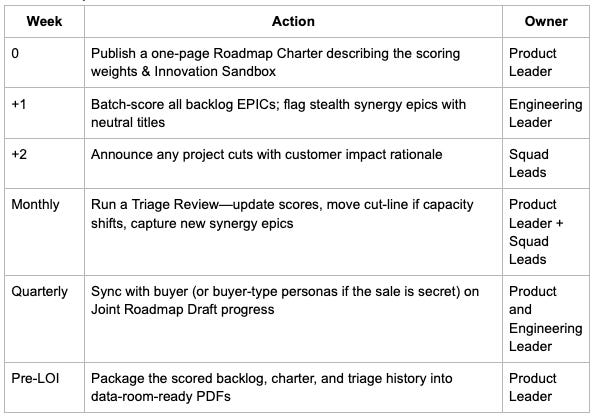

Semi-Reasonable Implementation Timeline

Implementing your acquisition-ready roadmap prioritization requires a structured approach with clear ownership and timelines. Execution excellence signals potential acquirers that your team can deliver consistently, impacting valuation discussions.

This 12-week timeline balances immediate action with sustainable rhythm, maintaining business momentum while reorienting your roadmap to high-value initiatives that strengthen standalone operations and potential acquisition outcomes.

This cadence ensures effective governance while accommodating evolving acquisition discussions and market shifts. Consistent execution is key. Show potential acquirers that your team can systematically implement strategic priorities, as this is a valuable asset post-acquisition.

Addressing Team Anxiety When the Sale Is Still a Secret

Teams can sense acquisition prep. Ideally you can read-in your team but the risk of leaks go up with every person that is aware of conversations. If you can’t be transparent, here’s how to respond to common team concerns:

Sudden project kills → "Are we being prepped for sale?"

Announce project cuts as part of a refinement of your product strategy and tighter focus. Every cancelled feature frees capacity for reliability, scalability, or a top customer pain. Publish a 2-sentence rationale the day the cut lands.

Stability & cost focus → "Vision is dying"

Brand CapEx-friendly work as a Reliability Sprint, framed as prepping for 10× workload and up-market growth.

Documentation Sprints → "Audit prep?"

Bundle under an Engineering Excellence OKR (test coverage, performance budgets, SOC2). It reads as résumé builders, not exit chores.

Leadership Absence

Explain time blocks as strategic partnership or fundraising meetings, which are both NDA-safe.

Fear of losing innovation

Hard-allocate 15–20 % of every sprint to an Innovation Sandbox chosen by squads. Creativity gets an explicit runway even as priorities tighten.

Maintaining team motivation during this period is critical. The talent the acquirer is paying for must remain engaged through closing and beyond.

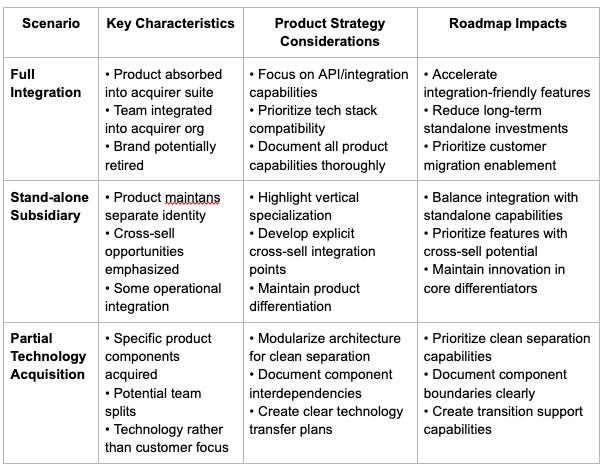

Contingency Planning for Different Acquisition Scenarios

Scenario Planning Matrix

Not all acquisitions end with you being assimilated by the acquirer. Different scenarios require different product strategy adaptations:

For each scenario, consider these specific roadmap adaptations:

Full Integration Scenario

Prioritize standardizing on the acquirer's technology patterns where feasible. A common one here is you’re using something like Amazon’s Cognito, and your acquirer hosts everything on GCP.

Explore customer data migration capabilities and tools

Identify and document product capabilities for potential preservation

Stand-alone Subsidiary Scenario

Develop integration points for cross-selling between product lines

Create shared authentication and user management capabilities

Maintain independent innovation capacity in core areas

Partial Technology Acquisition Scenario

Increase modularity of desired components

Develop clean APIs between components likely to be separated

Create transition documentation and knowledge transfer materials

Demonstrating Value Through SaaS Metrics

Valuation multiples are increasingly tied to KPIs rather than solely to growth potential. A strategic presentation of key metrics can significantly enhance acquisition premiums and overall company valuation. Well-documented and clearly presented metrics serve as compelling evidence of sustainable business value, allowing you to communicate your value effectively during due diligence and maximize your company’s perceived worth to potential acquirers and investors.

Key Metrics That Drive Acquisition Premiums

These metrics most directly impact valuation multiples:

Net Revenue Retention (NRR)

Target: >100% essential, >120% for premium multiples

Documentation: Cohort analysis showing consistent expansion

What it shows: Product delivers ongoing value driving expansion

Rule of 40 Performance

Target: Growth Rate + Profit Margin > 40%

Documentation: Trending improvement over time

What it shows: Business balances growth with operational efficiency

LTV Ratio

Target: >3:1 for healthy acquisition economics

Documentation: Calculation methodology and cohort analysis

What it shows: Customer acquisition approach is sustainable and profitable

Gross Margin

Target: >80% for SaaS businesses

Documentation: Componentized margin analysis

What it shows: Product can scale efficiently without proportional cost growth

Packaging SaaS Metrics for Acquisition Discussions

Effective metrics presentation significantly impacts perceived value:

Metrics Dashboard Structure

Organize metrics hierarchically (top-line business health to component metrics)

Show trending over 4-8 quarters to demonstrate momentum

Include a comparison to relevant benchmarks for context

Segmentation and Granularity

Break metrics down by customer segment/size

Show performance by acquisition channel

Demonstrate performance across product modules/capabilities

Narrative Connection to Product Strategy

Connect metric improvements to specific product initiatives

Document cause-and-effect relationships in product changes

Create forward-looking projections based on roadmap execution

Additional Frameworks for Acquisition-Ready Product Leaders

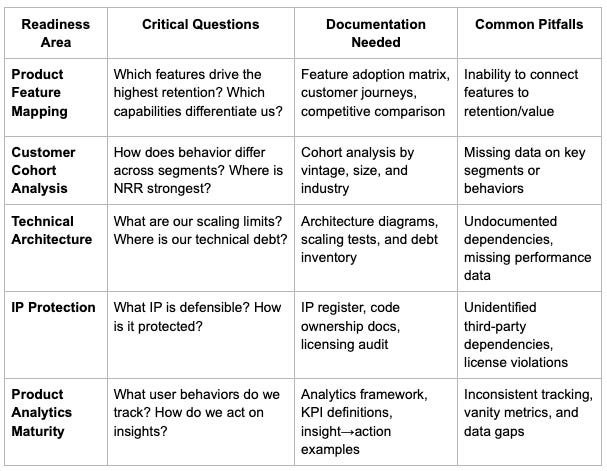

The Pre-Diligence Readiness Framework

Before formal diligence begins, use this framework to assess and improve your readiness:

Assign an internal owner to each area and rate your readiness from 1-5. Focus remediation efforts on your weakest areas first.

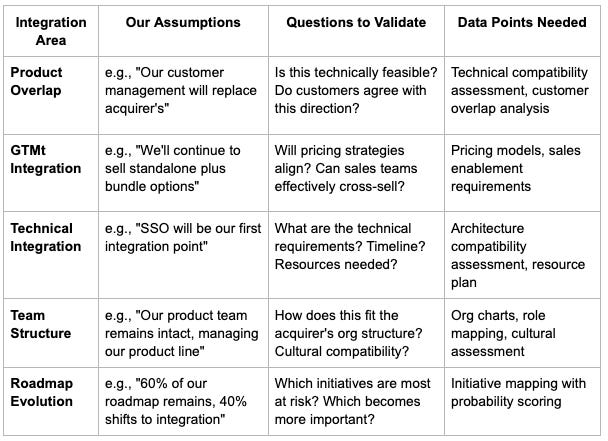

The Integration Assumptions Matrix

This framework helps identify assumptions about post-acquisition integration that should be validated before they become problems:

Document these assumptions early and seek to validate them through informal conversations before they become binding commitments.

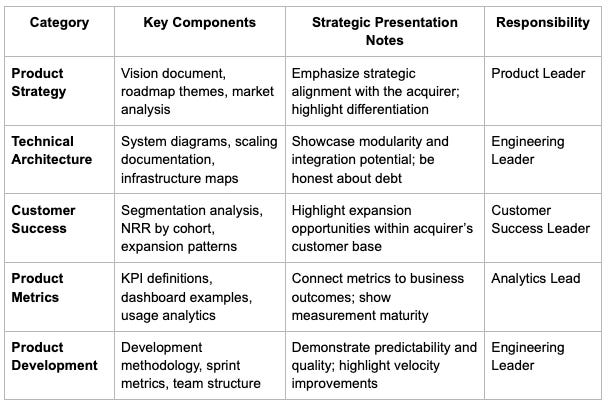

The Data Room Preparation Matrix

Ugh, maintaining a data room is a real grind. You can set yourself up from the start by organizing your product documentation for the data room using this framework:

Prepare executive summaries (2-3 pages) and comprehensive documentation for each category, arranged in a consistent structure.

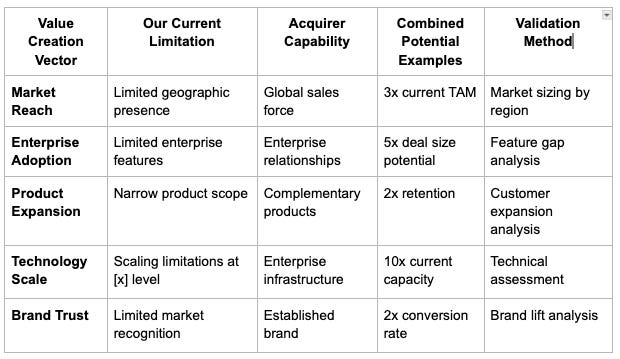

The Value Acceleration Framework

Use this framework to identify how an acquisition could accelerate value creation for both parties:

Quantify the potential value creation in each area and prioritize integration activities that unlock the greatest combined value.

The Reverse Due Diligence Framework

While acquirers perform due diligence on you, this framework helps you evaluate whether they're the right fit:

Use this framework for early private assessment and structured conversations when appropriate.

Conclusion: Building Lasting Value

The most successful acquisition-ready product strategies create value regardless of exit timing. By following the frameworks outlined in this guide, Series A product leaders can build organizations that thrive independently while positioning favorably for potential acquisition.

Remember these critical principles:

Value creation starts with customer outcomes - Metrics that drive premium valuations all trace back to delivering exceptional customer value.

Technical excellence pays dividends - Clean architecture, manageable technical debt, and scalable infrastructure create value in all scenarios.

Transparency builds trust - Honest communication within appropriate constraints builds the foundation for successful transitions.

Differentiation drives premiums - Clear, defensible product differentiation remains the core driver of acquisition interest and valuation.

Metrics tell your story - Rigorous tracking and presentation of SaaS metrics translate product strategy success into valuation discussions.

By building your product strategy with these principles in mind, you create a win-win scenario: a stronger standalone business that simultaneously commands premium acquisition interest when the time is right.

Acquisition Readiness Checklist

☐ Document technical debt inventory with remediation roadmap

☐ Create architecture diagrams showing system components and interactions

☐ Develop API documentation and integration guides

☐ Establish metric tracking for NRR, Rule of 40, LTV, and other key indicators

☐ Document product differentiation with customer evidence

☐ Create roadmap themes showing strategic direction beyond features

☐ Implement a weighted scoring model for roadmap prioritization

☐ Establish an innovation program with dedicated capacity

☐ Create contingency plans for different acquisition scenarios

☐ Prepare synergy models showing cross-sell/integration potential

☐ Complete Pre-Diligence Readiness assessment

☐ Document Integration Assumptions Matrix

☐ Organize documentation using Data Room Preparation Matrix

☐ Analyze potential value acceleration opportunities

☐ Develop criteria for reverse due diligence on potential acquirers